2022-02

Introduction:What is the main expenditure of a war? What are the sources of financing for the war? How does war affect a country's economy? From October 2021, the conflict between Russia and Ukraine continues to escalate.

Source: Internet synthesisAuthor: Xiao BianClick:855

What is the main expenditure of a war? What are the sources of financing for the war? How does war affect a country's economy?

From October 2021, the conflict between Russia and Ukraine continues to escalate.

At the height of the tension, Russia assembled nearly 150,000 soldiers in the Russian border area close to Ukraine, the United Kingdom delivered the first batch of anti-tank weapons to Ukraine, and the US military aided Ukraine with 170 tons of weapons and 130 tons of military equipment.

When the war seemed to be on the verge of breaking out, on February 15, the Russian Ministry of Defense announced in a high-profile manner that some troops would be withdrawn from the Russian-Ukrainian border. The Russian-Ukrainian border is beginning to show signs of easing, but the conflict is far from over.

From ancient times to the present, from the West to the East, the essence of war has always been a conflict of interests.

In the words of Engels, war was once the most important purpose of life for some peoples to satisfy their greed and gain wealth. Engels called them barbarians. In their view, plundering is easier or even more honorable than creative labor. thing.

However, smart politicians and military strategists will not start war blindly, because war is really a matter of too much labor and loss of money and money. If you do not calculate this economic account, not only will you not gain benefits, but it will even paralyze a country's economy.

01

What is the cost of war?

How much does it cost to fight a war?

In the Kosovo War in 1999, the United States spent more than $7 billion in air strikes that lasted 78 days; in the two-month war in Afghanistan in 2001, the U.S. military alone spent more than $10 billion.

The Iraq War, which began in 2003, cost the U.S. between $28 billion and $30 billion in less than two months of offensive time.

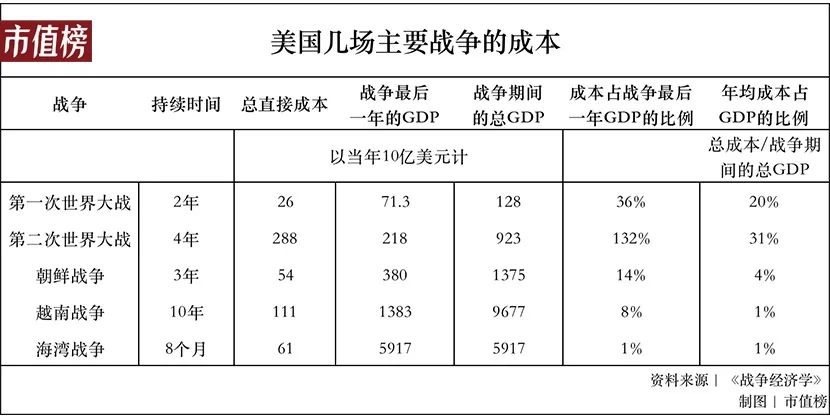

Let us take the United States as an example to sort out the expenditures that the United States has paid in major wars in the past:

Where is the silver of these white flowers? Arms and personnel are the main expenditures.

For example, during the First World War, the total cost of the war in the United States in 1918 was close to 36% of the annual GDP. In order to prepare for this war, the United States also turned 30% of its automobile production capacity to tank production.

During World War II, U.S. military spending further increased. At its peak, military spending alone accounted for one-third of U.S. GDP. In 1944, this figure was 37.9%. Whether it is total direct cost or per capita direct cost, U.S. war spending have reached their peak.

Especially after the attack on Pearl Harbor, the United States once again increased weapons production.

From 1918 to 1933, the United States produced only 35 tanks; by 1940, the United States produced 309; in 1943, the production of American tanks increased to a staggering 29,500. On a more macro level, the United States produced a total of 88,430 tanks during World War II, compared with 24,800 in Britain and 24,050 in Germany.

The same is true for aircraft. In 1943 and 1944, when the annual output was the highest, the United States produced 85,898 and 96,318 aircraft respectively.

Looking at the expansion of military personnel, a set of data comparisons is very representative: Before 1939, the number of US troops had never exceeded half of the 280,000 people stipulated in the National Defense Act of 1920, but by 1942, the number of US troops had exceeded 280,000. 9 million people.

In addition to the consumption of manpower, material resources, and financial resources directly invested in the war, the war will also make the country and the government pay for the welfare or subsidy expenses after the soldiers are discharged.

During the 1991 Gulf War, more than 100,000 service members suffered from chemical-related "Gulf syndrome," and more than 40,000 of them were chronically disabled. Even 16 years after the end of the war, the U.S. government still needs to provide more than $4.3 billion in grants, pensions, and pensions to 200,000 veterans.

In addition to these direct costs, the damage to the national economy caused by the war is greater and has a longer-term impact.

One of the most direct reasons for investing heavily in war resources is that in most cases, whether it is a war attacker or a war defender, its offensive performance or defensive performance is a linearly increasing function of the cost of attack or defense, that is, the attack. The greater the cost or defensive cost, the greater the offensive or defensive performance.

In the context of high and new technologies such as information technology, biotechnology, and space technology, when one side of the war continues to increase its investment in weapons and other resources, the war will enter another logic: asymmetric warfare.

To put it simply, war machines cultivated through massive military spending have created a disparity in strength against the enemy.

As a military power, the more the United States increases its military expenditure, expands its arms, prepares for war, and invents new weapons, the more it can improve its attack power, and the more it can achieve greater victories in an asymmetric war where the strong bully the weak. It has encouraged America's desire and will to use force in the world.

Since war has to pay such a high cost, where does the money come from?

02

Where does the money come from?

Nobel Laureate in Economics Stiglitz's book "Three Trillion Dollars of War - The True Cost of the Iraq War" has this dialogue printed on his red girdle:

US GOVERNMENT: The Iraq War is free. Neither cutting government spending nor raising your taxes, nor causing inflation.

The American People: Where did the money come from?

U.S. Government: Borrowed from foreign governments.

This virtual dialogue not only pointed out the popular war financing channels, but also pointed out the unique war financing methods of the United States as a global military and financial power. Generally speaking, war financing is mainly divided into taxation, bond issuance, and money printing.

Let's look at the first financing method: tax.

Taxation is an ancient means of filling the treasury and providing economic support in times of war. Since ancient China, the emperors of all dynasties have relied on the collection of salt tax, human tax, land tax and so on.

Taxation is the most important source and form of national public finance, and is generally used for urban infrastructure, education, medical care, salary payment for public servants, and military expenditures. In wartime, military spending increases, and accordingly, spending on non-military spending decreases.

Only the mobilization of taxes will naturally not support the huge war expenses. In times of war, there are often temporary taxes to open source.

For example, in 1799, during the British war against Napoleon, in order to meet the needs of war expenses, then British Prime Minister Peter Pitt initiated the income tax. It is different from the later income tax. It is a temporary war tax, which was stopped in 1802 when the war subsided. In 1803, when the war resumed, it was resumed, and it was abolished in 1815 when the war ended.

During the First World War and the Second World War, some European countries also levied "war tax" or "war profits tax" to raise war funds.

Too much taxation tends to cause civil unrest, so there is some "war tax" that falls on the rich/businessmen.

For example, in the late Qing Dynasty selling officials, according to some estimates, in many cases, about 30% of the Qing Dynasty’s war expenses were subsidized by the income from selling official positions; another example, the income tax mentioned above is also a tax for the wealthy, in the name of Protect the private property of the rich.

This approach doesn't always work, especially when the rich are in power. In the Middle Ages, European countries were at war again and again. The nobles and princes were rich and powerful. In order to protect their own interests, they spontaneously formed a firm alliance to hinder tax increases. The rulers had to think otherwise.

Let’s look at the second financing method: borrowing money and issuing bonds.

It may be hard to imagine that the first sovereign lending in human history was for war, and war was the original motivation for borrowing.

In the 5th century BC, the Peloponnesian War broke out between Athens and Sparta. One side was the wealth center of ancient Greece, and the other side was still using cheap and bulky iron coins for transactions, which was only better than barter. Go ahead.

Sparta's confederates, some small city-states, due to the annual tribute to the powerful Athens, did not have much military expenditure, and the protracted war made Sparta fall into the predicament of insufficient ammunition, and had to borrow the reserves of Olympia and Delphi Temple. Give honors to encourage people to donate money and help. Ultimately, the 27-year war ended Athens' classical age and status as a great power.

At this time, borrowing money belongs to the category of the ruler's private debt, turning the ruler's private debt into a public debt supported by national credit and paying interest to the people after the emergence of the parliament.

To a certain extent, it can be said that the establishment of the Bank of England (1694) was to open up channels for citizens to save, to raise military expenses for dealing with Louis XIV, and to issue bonds was also the economic support for the success of his empire on which the sun never sets.

Since then, issuing bonds has become a common channel for raising military spending.

This conventional financing method was learned by the Japanese, but not by the Qing government. This is also one of the important reasons why Japan won the Sino-Japanese War (1894) in a small space.

At that time, the Beiyang Navy was known as the No. 1 in Asia, and ranked first in the world. It was not inferior to Japan, but in the end it was unable to buy ammunition. The root cause is of course the corruption and backwardness of the Qing Dynasty, but the fact that the financial industry is weaker than Japan's is also the reason why it took less than a year to concede defeat and negotiate.

In addition to the tax sales officials mentioned above, the Qing government at that time was also able to loot the people and banks, and there was no way to make money. Japan is deeply influenced by Chinese culture and has few financing channels. But after the Meiji Restoration, I learned a lot of Western financial systems, first issuing bonds to carry out economic and military reforms, and then issuing bonds to fight wars. Just before the Sino-Japanese War, Japan also issued huge amounts of bonds.

The third way of financing is to start the money printing machine.

Taxation and issuance of bonds are all movements of the total amount of money, and the total amount of money may not be able to meet the needs of the war. Creating money has become a common practice in the wartime economy.

During the American Civil War, the northern government of the United States sold treasury bills and bonds to banks, but the banks found it difficult to resell these treasury bills and bonds in the secondary market, so they were no longer willing to use limited gold to undertake government bonds.

So in 1862, the government began printing $150 million in U.S. bills, making it legal tender.

Under normal circumstances, banknotes cannot be printed if they want to be printed. Between the 1860s and 1970s and the 1940s, the world monetary system was on the gold standard. How many banknotes can be issued depends on how much gold reserves there are.

The gold standard has a natural tendency to deflation, because gold reserves are limited and mining is slow, while productivity increases and economic growth rates are higher. Demand for gold was greater in wartime, so it was common to temporarily abandon the gold standard.

Over-issued currency is essentially endorsed by national credit, not gold reserves.

During World War I and World War II, some countries were unable to produce the materials needed for the war, and usually needed to borrow and consume a large amount of gold reserves to finance the purchase of materials. To support these deficits, most belligerents imposed restrictions on gold exports.

These ad hoc policies during wartime had side effects. Raising taxes will increase the burden on the people and make the government lose support from the people; cutting non-military spending will reduce public welfare in health care, education, etc.; issuing bonds will require the government to bear the interest, and may even cause the country to go bankrupt.

For example, between 1557 and 1575, the King of Spain declared the country bankrupt twice. Although the country was not penniless, the inability to pay its debts was a great harm to the country's credit.

Under a currency system endorsed by national credit, the impact of over-issuance of currency may be several times the amount of currency issued.

The price of war affects people long after the last shot of the war is over. Here's another quote from Stiglitz.

03

The post-war cost is heavier

"There is nothing left in Berlin, no houses, no shops, no transport, no government buildings, the legacy of the Nazis to the people...just a few broken walls...Berlin is now just a geographical coordinate with a mountain of broken bricks and tiles. ” This statement by a reporter from the New York Herald Tribune is undoubtedly the best footnote to the cost of war.

Bullets cannot be used for reproduction, war only destroys resources.

World War II was the deadliest war in human history, involving more than 2 billion people in more than 60 countries. The war killed more than 70 million people and injured 130 million.

As a defeated country, Germany had more than 5 million dead soldiers and about 2 million civilians. Before World War II, Germany's total population was about 80 million (after the annexation of Austria and other places, it had about 66 million). Nearly a tenth of the population disappeared due to the war, mostly young adults.

The victorious countries also paid a heavy price. The Soviet Union killed more than 20 million people.

Every time a war occurs, there will be a lot of casualties. Under the industrial system, the lack of male labor force and the destruction of infrastructure, industrial equipment and other resources made the post-war economic reconstruction particularly difficult. Coupled with the special economic policies during the war, both the defeated and the victorious countries fell into economic difficulties. among.

The first effect is inflation.

After the end of World War I, Germany not only had to repay the wartime borrowings, but also had to pay a huge indemnity of 132 billion marks. If Germany could not get this money, France joined Belgium and Poland unceremoniously to enter the economic lifeline of Germany—— In the Ruhr Industrial Zone, known as the "Ruhr Crisis" in history, Germany can only choose to print money crazily.

The money supply was too high and the goods were not enough, causing prices to skyrocket and hyperinflation in Germany.

Before the war, 4.2 marks could be exchanged for 1 dollar, and after the war, 1 dollar could set up a family fund. The speed of price increases is almost absurd. A typical scenario is that a person buys a cup of coffee for 8,000 marks, and when he finishes drinking and goes out, the coffee has already sold for 10,000 marks.

By 1923, banknotes with a face value of 100 trillion appeared in Germany. Children used the banknotes to make kites, and the banknotes were used as firewood, which could be seen everywhere. At this time, the Mark has lost the value of the currency, and barter has become popular.

Similarly, post-World War II Japan also experienced an inflationary period. According to relevant data, between 1945 and 1949, the retail price index in Tokyo, Japan increased by 240 times.

The United States, which is not the main battlefield and is also a victorious country, counts its M2 in the last century, that is, the money supply, including cash checks and short-term reserves. high sex.

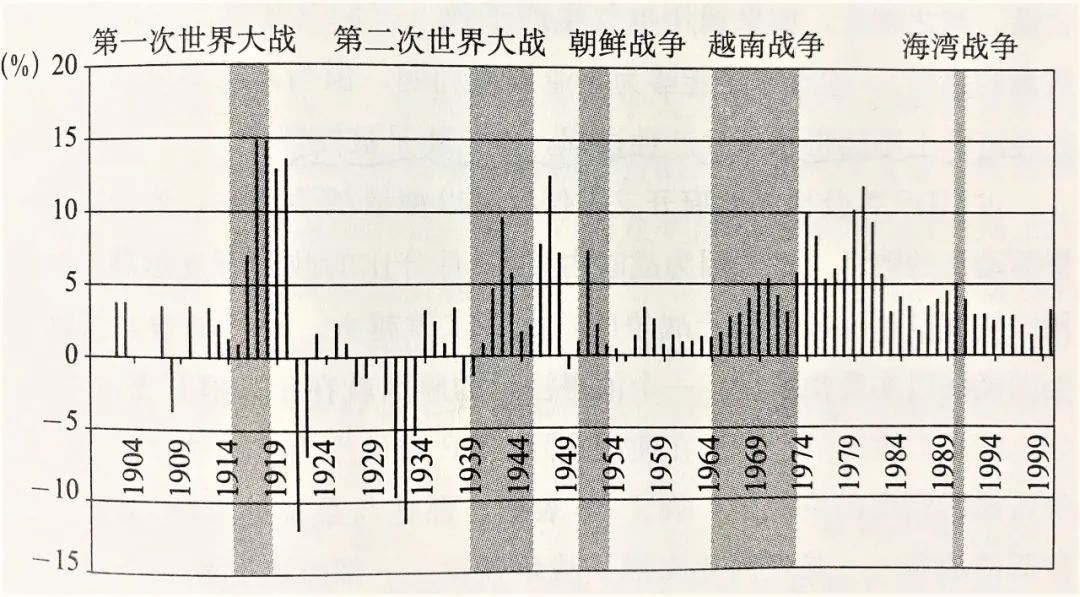

(Inflation rate in the United States from 1901 to 2000)

The years 1917-1918, 1941-1945, the late 1960s to 1970s (Vietnam War), and 1991 (during the Gulf War) were also peak periods of U.S. inflation. In fact, including the one or two years after the war, the inflation rate was also at a relatively high position.

However, compared with Germany and Japan, the inflation rate in the United States is much more moderate, which is also due to the US dollar as an international currency, and its currency over-issue and inflation can be paid by the world. It is also why the virtual dialogue above said that other countries should bear the cost of war.

The second impact is on the total economic volume, that is, the level of GDP, which will be differentiated in different countries.

A simplified formula for GDP is the sum of investment, consumption, net exports and government purchases. The post-war economic recovery of the main battlefield countries takes time, and the people of the defeated countries generally lack confidence and are more prone to post-war GDP decline, which is also one of the costs of war.

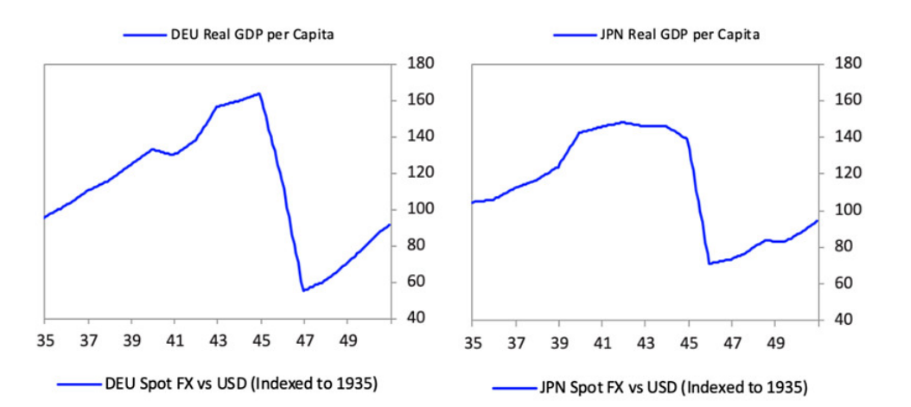

During World War II, the per capita GDP of Germany and Japan fell by at least half, and their currencies depreciated significantly after the war.

For the big winner, the United States, GDP rose during the war. From 1941 to 1945, the average annual growth rate of GDP was as high as 11%, and the unemployment rate fell. But after World War II passed, the United States could not maintain the rapid growth of GDP due to the lack of strong military demand.

The third effect is the huge debt to the warring countries.

Britain, the old empire on which the sun never sets, was the first country to enter modernization. It was the leader of world development from the 18th to the 19th century. Its decline was related to the huge debt caused by the two world wars.

Because of World War I, the United Kingdom was pulled down from the position of the world's largest creditor nation, and the United States filled it. Because of World War II, the power to dominate the world financial order was completely lost, replaced by the United States, and the United Kingdom became an economically dependent role.

During World War II, under the Lend-Lease Act signed by Roosevelt, the United States provided war subsidies to the Allies, and Britain was the biggest beneficiary. The bill also had the additional condition that the UK must make the pound freely convertible.

No one wants to hold the currency of a country at war, and the liberalization of convertibility will make people sell the pound for a stronger currency or gold.

Some historians and economists in the U.K. believe the clause contributed to the prolonged weakness in the pound and was a step in the U.S.’s efforts to undermine Britain’s superpower status.

After World War II, on the one hand, the British pound was weak, and on the other hand, 75% of the world's gold reserves were in the hands of the United States. The dollar became the world currency by pegging it to gold, and the United Kingdom could no longer compete with the United States.

During World War II, the debts Britain owed to the United States and Canada were not repaid until 2006. It took 60 years for the United Kingdom to turn a new page. It took Germany 90 years to pay off 132 billion marks in reparations plus interest.

04

Epilogue

In all wars, there are winners and losers. Does this mean that if the party participating in the war can grab greater economic benefits, then it will be the winner?

of course not.

The savage nature of war lies in the fact that under the survival law of the jungle, the victorious side regains control of the rules of the game, and they can always have a higher initiative in the distribution of benefits, making themselves the biggest beneficiaries.

But war has irresistible destructiveness. It brings displacement, displacement, and loneliness at the cost of bloodshed and death. Its destructiveness is powerful enough to bring down a city, a nation, and a civilization. It is also a bloody lesson in human history.

The economic account may be calculated clearly, but when it comes to ordinary people, no matter how this account is calculated, there is no winner.

DISCLAIMER: THIS ARTICLE IS FROM THE INTERNET AND DOES NOT REPRESENT THE OPINIONS OF 鹏盛资本PENGSCPA. 鹏盛资本PENGSCPA DO NOT GUARANTEE THE ACCURACY OR COMPLETENESS OF THE ARTICLE, WHICH IS FOR YOUR REFERENCE ONLY. IF ANYONE SUFFERS DIRECT, INDIRECT OR RELATED LOSSES DUE TO THE USE OF THE MATERIALS IN THIS ARTICLE, 鹏盛资本PENGSCPA WILL NOT BE LIABLE FOR SUCH LOSSES.