2022-03

Introduction:With the advancement of the exchange rate market-oriented reform and the improvement of the exchange rate control mechanism, the RMB exchange rate has become an important stabilizer of the macro economy, highlighting the tenacity advantage of the RMB.

Source: Internet synthesisAuthor: Xiao BianClick:1032

With the advancement of the exchange rate market-oriented reform and the improvement of the exchange rate control mechanism, the RMB exchange rate has become an important stabilizer of the macro economy, highlighting the tenacity advantage of the RMB. In the future, the market-oriented reform of the RMB exchange rate and the management of expectations will continue to be deepened to adapt to the challenges brought about by changes in domestic and foreign economic and financial situations, and to better play the role of the exchange rate in stabilizing the economy and market expectations.

1. The stability of the RMB exchange rate has a solid economic foundation

In the past two years, the exchange rate of RMB against the U.S. dollar has always remained within the fluctuation range of [6.3, 7.0], and the fluctuation range is not greater than that of other emerging market countries. Changes in external markets and macroeconomic fluctuations have not caused excessive fluctuations in the exchange rate of RMB, but Under the guidance of expectations and various regulatory policies, the two-way volatility of the RMB exchange rate has continued to increase. From the perspective of the annual average exchange rate, the exchange rate of the US dollar against the RMB has risen from 8.28 in 2000 to 6.9 in 2020. The fluctuation range during this period is relatively stable, rather than the depreciation of more than 30% or even 50% in emerging market countries such as South Africa, Brazil, and Russia. There is no similar trend of rapid appreciation in Japan in the 1990s. It is expected that the renminbi will remain independent in the future, and it is unlikely that there will be an unstable trend of unilateral rise or continuous depreciation as feared by the outside world, and the expected management of the renminbi exchange rate will also become more mature.

The reason why the RMB exchange rate did not appreciate or depreciate unilaterally as expected by the outside world, but instead showed two-way fluctuations of ups and downs, can be viewed from three aspects:

First, China is still an important engine leading the global economic growth, and it is one of the few economies that maintains a relatively high economic growth rate among the major large economies. According to data released by the World Bank, China's global share of gross domestic product (GDP) increased from 3.6% in 2000 to 16.28% in 2020, while China's contribution to world economic growth (calculated by the exchange rate method) increased from 2000 increased from 8.24% to 33.36% in 2020. China's economy has maintained a medium-to-high growth rate for more than 40 years, with an average annual growth rate of nearly 9%, which has become an important material basis for the stability and resilience of the RMB exchange rate. Second, China's export share and trade surplus have always maintained a relatively large advantage, becoming an important force for the stable and sustainable development of globalization and international trade. According to data released by the Ministry of Commerce of China, the absolute value of China's exports increased from $249.2 billion in 2000 to $2.6 trillion in 2020, and its trade surplus increased from $24.1 billion in 2000 to $523.9 billion in 2020. The increasing share of exports and the steady growth of the trade surplus have provided a good expectation for the stability of the RMB exchange rate. Third, China's economy has maintained a relatively stable and sustainable growth momentum, attracting more overseas investors. Especially in the context of sluggish global economic growth and unstable financial markets, China has been the world's most important overseas investment destination for several consecutive years. one. According to data released by China's Ministry of Commerce, China's foreign direct investment increased from US$53.5 billion in 2003 to US$144.37 billion in 2020, and is expected to exceed US$170 billion in 2021.

2. High-level opening up and high-quality economic growth consolidate the attractiveness of RMB assets

The outline of the national "14th Five-Year Plan" proposes to comprehensively improve the level of opening to the outside world, promote the liberalization and facilitation of trade and investment, continue to deepen the opening up of the flow of commodities and factors, and steadily expand the institutional opening of rules, regulations, management, and standards. Among them, a very important aspect is to steadily advance a series of institutional reforms and opening-up policies related to the RMB exchange rate. On the one hand, through the continuous and in-depth implementation of the high-level opening policy, it will provide a more smooth, convenient and positive policy environment for the market-oriented reform of the RMB exchange rate, and lay a better foundation for the convenient use of the RMB in the future; on the other hand, the high-level opening-up policy is expected to And the market environment will be conducive to improving the facilitation of the cross-border use of RMB, prompting more foreign companies and residents to hold and use RMB.

In recent years, against the backdrop of unstable global economic situation and large fluctuations in the international market, the scale of RMB financial assets held by foreign institutional investors and individuals has continued to increase. According to the data of the State Administration of Foreign Exchange, the scale of RMB stocks + bonds held by foreign institutional investors and individuals has increased from 743.824 billion yuan in December 2013 to 7.5 trillion yuan in September 2021, an increase of 10 times in 8 years. , highlighting the continued optimism of international investors towards the RMB.

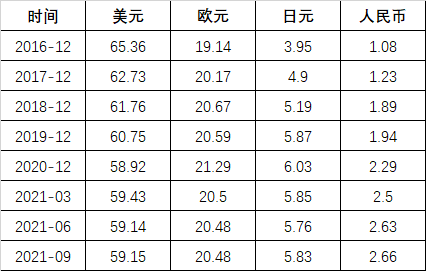

At the same time, great progress has been made in the cross-border use of RMB as an international reserve currency and international payment and settlement. According to data released by the International Monetary Fund, the share of the RMB as a global reserve currency rose from 1.08% in December 2016 to 2.66% in September 2021. The scale of the central bank's RMB currency swap has increased from 180 billion yuan in December 2008 to about 4.16 trillion yuan in December 2021, an increase of 23 times. Moreover, as the scale of my country's cross-border trade continues to expand, the use of RMB in cross-border trade and foreign investment has grown substantially. According to data from the People's Bank of China, the value of RMB business settlement for cross-border trade increased from RMB 352.9 billion in December 2012 to RMB 741.7 billion in November 2021, and the value of RMB direct investment settlement business increased from RMB 63.4 billion in December 2012. 521.9 billion yuan by November 2021.

To sum up, there are three main reasons for the continuous deepening of RMB internationalization: First, the road to global economic recovery has encountered various challenges after the 2008 economic crisis. Developed countries represented by Europe, the United States and Japan have generally implemented loose monetary policies, and the volatility of various asset prices has intensified. , and adopt low interest rate or even zero interest rate policy, which leads to the continuous decline in the attractiveness of assets, while emerging market countries have problems such as financial market instability and excessive exchange rate fluctuations. International investors have insufficient confidence in the assets of these countries, which are stable and safe. Second, in recent years, China has accelerated its efforts to optimize economic layout and promote economic transformation. While maintaining stable economic growth, the quality of economic development has also been greatly improved, export competitiveness has continued to improve, and investment opportunities in emerging industries have expanded. Renminbi assets perform better and have more room for future growth, attracting more and more international investors to expand their investment in the Chinese market; third, China is accelerating its pace of steadily advancing high-level opening up, relying on Shanghai Lingang In areas such as the New Area, the Guangdong-Hong Kong-Macao Greater Bay Area, and the Hainan Free Trade Port, a number of high-level opening-up policy pilot projects have been successively launched in areas such as capital markets, financial markets, and cross-border investment and financing. Institutional opening has laid a good policy foundation.

Table 1 Shares of major global reserve currencies (unit: %)

Data source: International Monetary Fund (IMF), Wind Information

3. The RMB exchange rate is more flexible and gradually adapts to the international market

At present, the exchange rate of RMB against the U.S. dollar has risen above the psychological mark of "7" for two consecutive years, while the foreign exchange market and financial market have not experienced excessive fluctuations, nor have the RMB appreciated rapidly or unilaterally continued to rise. Acceleration and anticipation management lead to become more resilient. In-depth study of the reasons, in addition to the more stable expectations of domestic and foreign markets and policy-making departments for the fluctuation of the RMB exchange rate, the RMB itself is also more adaptable to the rapid changes in internal and external situations, while policy management departments, enterprises and overseas investors The range of appreciation or depreciation has greater psychological tolerance, and the so-called psychological defense line of RMB exchange rate changes is not representative. The change of the RMB exchange rate is still fundamentally determined by the supply and demand relationship in the international foreign exchange market, and the cross-border use of RMB and the process of RMB internationalization are cyclical. The appreciation or depreciation of RMB is closely related to the level of economic development and the degree of market economy It is related to, rather than divorced from, economic fundamentals and the laws of development of the financial market itself.

It is manifested in two aspects: First, the keynote of the market-oriented reform of the RMB exchange rate has been basically established. Foreign exchange management departments, the market and investors have consistent expectations for the long-term better performance of the RMB. The main direction adhered to in 2010 is also an important policy cornerstone for promoting the stability of the RMB. In the past, the outside world held different opinions on RMB exchange rate intervention, but after several rounds of exchange rate reform pilots, the goal of exchange rate marketization reform has become clearer, including improving a managed floating exchange rate system based on market supply and demand, adjusted with reference to a basket of currencies The expected development of the exchange rate is guided by various methods such as foreign exchange loan reserve ratio, counter-cyclical factor adjustment and issuance of central bank bills; second, the RMB has gradually become resilient and competitive to resist various internal and external risks and challenges. Since the occurrence of major shocks such as trade frictions and the new crown pneumonia epidemic crisis, the RMB exchange rate has not fluctuated significantly, and the exchange rate range has always remained within a reasonable range. In the cycle of periodic appreciation or depreciation, the RMB exchange rate has shown more independence. trend. Judging from the performance of the Renminbi Exchange Rate Index (CFETS), the Renminbi and the U.S. dollar have gradually stepped out of their independent curves. Although the short-term reflects the impact of the dislocation of China and the U.S. monetary policy and the dislocation of economic recovery, this trend also shows that the Renminbi has gradually adapted to the international financial changes in the market.

From the perspective of future trends, the renminbi will gradually have diversified functions such as asset price discovery, hedging, and asset allocation, making the renminbi's application in the international financial market and domestic and foreign investment more extensive. There are three considerations for this judgment: First, China’s GDP and export trade shares have increased significantly, the degree of integration into globalization is getting deeper and deeper, and the impact on the global economy and trade is getting bigger and bigger. The demand for international payment, settlement and application continues to strengthen; second, the scale of China's overseas investment and investment in China by multinational companies from all over the world is increasing, which makes the application of RMB in international business development and project investment more extensive. The pace of horizontal opening up provides better policy guarantees for the application of the RMB, unblocks cross-border investment and financing facilitation channels, and serves domestic and foreign investors and multinational enterprises. There will also be new changes in the relationship between supply and demand, payment and settlement models, and development paths. It is more forward-looking to explore the innovation of cross-border RMB applications in new trade formats. It is necessary to study the opportunities and improve the corresponding risk response measures.

4. Summary

At present, the development of the international situation is characterized by uncertainty and instability, the adjustment of monetary policies of major countries is accelerating, and the international financial market may continue to experience violent fluctuations. In general, the RMB exchange rate itself has gradually acquired the inherent ability to resist various external financial risks and challenges. In the future, under the guidance of policy expectations and macro-prudential management, the flexibility of the RMB exchange rate will continue to increase. In the long run, the RMB will have a broader space for development in the future, which depends on the trend of China's economic development and the continuous evolution of high-level opening-up policies. In addition to considering short-term factors when observing changes in the RMB exchange rate, we should also manage expectations with long-term thinking. We should not only see the advantages of RMB exchange rate maintaining resilience and flexibility in two-way fluctuations and internal and external balance, but also grasp the global economy and the global economy in the post-epidemic era. An important time window for my country's economic recovery, deepen research and promote the market-oriented reform of the RMB exchange rate, adapt to the trend of more flexible space for the RMB exchange rate and the expansion of fluctuations in appreciation and depreciation, and combine offshore finance and capital account opening. A smoother, more convenient and safer environment, thereby promoting the RMB exchange rate to remain basically stable at a reasonable and balanced level.

作者:邓宇,交通银行金融研究中心

DISCLAIMER: THIS ARTICLE IS FROM THE INTERNET AND DOES NOT REPRESENT THE OPINIONS OF 鹏盛资本PENGSCPA. 鹏盛资本PENGSCPA DO NOT GUARANTEE THE ACCURACY OR COMPLETENESS OF THE ARTICLE, WHICH IS FOR YOUR REFERENCE ONLY. IF ANYONE SUFFERS DIRECT, INDIRECT OR RELATED LOSSES DUE TO THE USE OF THE MATERIALS IN THIS ARTICLE, 鹏盛资本PENGSCPA WILL NOT BE LIABLE FOR SUCH LOSSES.